Real estate investors are eager to take full advantage of a community enhancement program that emerged from the Tax Cuts and Jobs Act of 2017 known as the Opportunity Zone program. The Opportunity Zone program was created to revitalize economically distressed communities using private investments rather than taxpayer dollars, and enables any investor to defer and ultimately reduce capital gains taxes on any asset by reinvesting the gain in underfunded communities.

What Are Opportunity Zones?

Opportunity Zones are census tracts generally composed of economically distressed communities. To qualify as an Opportunity Zone, the individual poverty rate of the tract must be at least 20% and median incomes cannot exceed 80% of the area median income. Up to 25% of areas that meet these income qualifications of the program in each state can be classified as an Opportunity Zone by the Governor of each state.

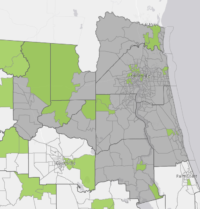

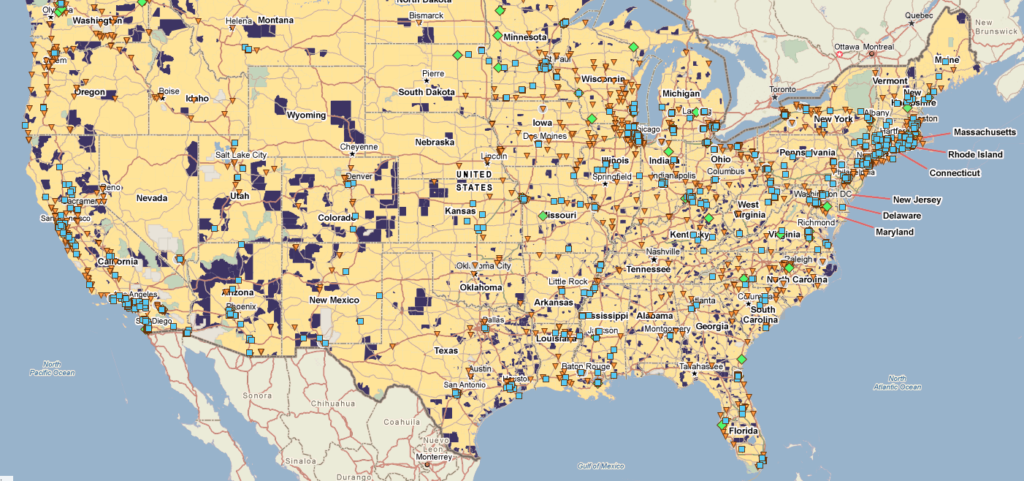

More than 8,700 opportunity zones have already been identified in the United States. The state of Florida has 427, including 34 in Northeast Florida.

Opportunity Zone Map

Why Invest in an Opportunity Zone?

Opportunity Zones allow for any capital gains to be deferred, provided those gains are invested in one or more Qualified Opportunity Funds within 180 days. Qualified Opportunity Funds are required to have at least 90 percent of its capital invested in qualifying investments in Opportunity Zones.

The Opportunity Zone Program offers investors three incentives for putting their capital to work rebuilding economically distressed communities:

- Temporary Deferral: An investor can defer capital gains taxes until 2026 by putting and keeping unrealized gains in an Opportunity Fund.

- Step Up Basis:

- A reduction: The original amount of capital gains on which an investor has to pay deferred taxes is reduced by 10% if the Opportunity Fund investment is held for 5 years and another 5% if held for 7 years.

- Permanent Exclusion

- An exemption: Any capital gains on investments made through the Opportunity Fund accrue tax-free as long as the investment as long as the investor holds them for at least 10 years.

For more information on investing in Opportunity Zones in Northeast Florida, contact our Investment team.

About the Author: Daniel Burkhardt, VP Investment Sales

Daniel Burkhardt joined the NAI Hallmark team in 2012 as a broker specializing in office leasing and investment sales and was promoted to Vice President in 2016. Over the past 4 years, Daniel has helped broker approximately 1.5 million square feet of sales and leasing transactions with a value of over $60 million; including several high profile deals including the sale of Butler Pointe, Baymeadows Business Center and Northeast Florida Industrial Center.