The arrival of COVID-19 and subsequent shut-down of the nation have left their mark on the commercial real estate industry. Business has returned, but in a much different way.

In a recent interview with the Jacksonville Business Journal, NAI Hallmark Managing Partner Keith Goldfaden discusses recent transactions and how the sector is adapting with the approaching of Q4.

Read the interview with Jacksonville Business Journal >>

Goldfaden, along Managing Partner Christian Harden and Senior Vice President Daniel Burkhardt, recently brokered the $20.4 million sale of a 289,850 square foot industrial warehouse — a process he said highlighted the challenges of COVID-19 — but the challenges weren’t limited to that sale alone.

Read our press release >>

The COVID-19 pandemic has been affecting the First Coast since mid-March. How has that impacted the real estate market?

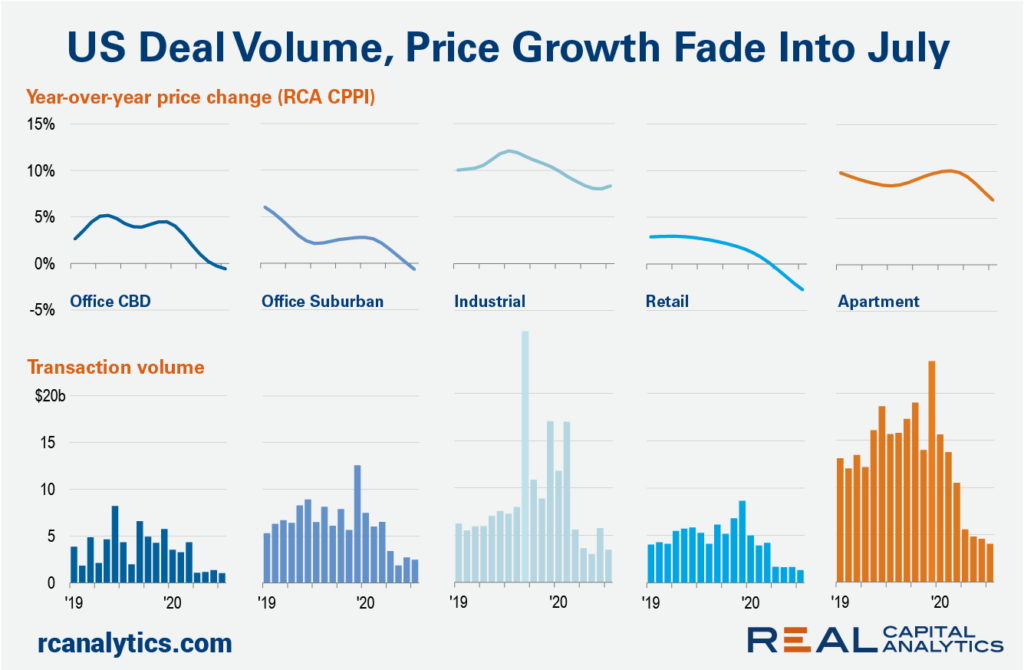

When COVID-19 hit, the commercial market ground to a halt for the most part. The good news is we’ve seen a real sharp rebound over the past few months. However, we’ve also seen a real dichotomy emerge in the sales market between different product types.

What I mean by that is, certain product types like industrial, data centers, apartments and essential retailers – they’re now in very high demand. Whereas you have other product types like hotels and non-essential retail that are having very little transactional volume.

What do you think is driving that rebound?

I think several things are driving this: First, there were several months with few transactions so once the shutdowns ended and people/companies started looking for deals again, there was an enormous amount of pent-up demand and capital looking for good opportunities. Second, given where risk-free interest rate instruments currently trade, investors are looking for alternative asset classes where they can generate adequate returns. Commercial real estate can still provide for these returns, especially with the low-interest rates on commercial loans. Lastly, given the upcoming election cycle and the possibility for significant changes to tax policy in the coming years, sellers are looking to complete sales before year-end to lock in the current capital gains tax rate.

How has the market reacted?

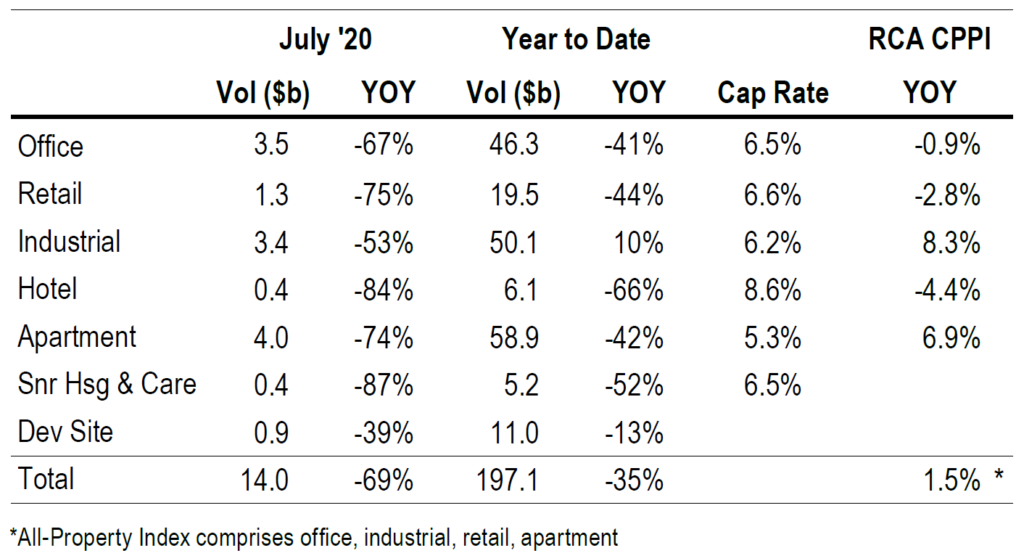

Well, the market has definitely come back over the last few months, but when you look at the raw data from earlier this summer, volume is nowhere near what it was in previous years. To give you a couple of data points, the July transaction volume for the entire country on the commercial side was down nearly 70% year-over-year.

Jacksonville wasn’t too dissimilar; as the transaction volume was down nearly 64% in the second quarter compared to 2019.

What’s driving this drop in volume is partly due to expectations between sellers and buyers growing further apart. You have sellers that think values are the same as they were pre-pandemic, and you have a lot of buyers that want discounts for the economic and health uncertainty that exists. You see this illustrated by the fact that prices of commercial property have remained relatively stable vs. the dramatic decline in transaction volume. I do think you’ll start to see volumes improve in the third quarter – but again, not nearly as high as recent years.

Source: Real Capital Analytics

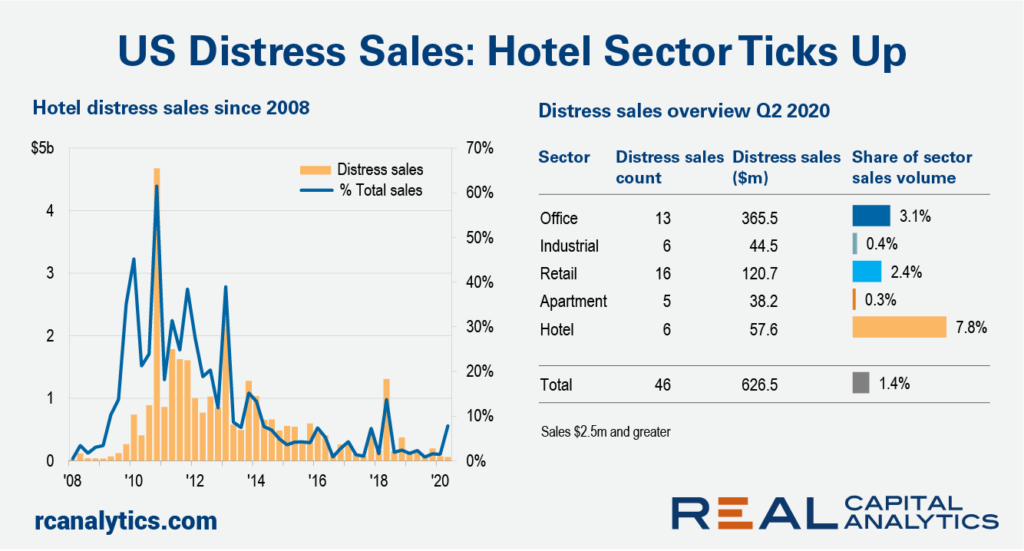

Typically, prices will adjust more quickly in this type of economic environment but there isn’t a lot of pressure yet on sellers to transact. They either have enough equity in their properties, significant capital reserves or lenders that are willing to work with them on forbearance agreements. Lenders haven’t started actively foreclosing and taking properties back, so there’s not a huge distressed market similar to that of the Global Financial Crisis.

I believe distressed sales will become more prevalent over the next six to eighteen months, with the majority occurring in the hotel and retail sectors.

Source: Real Capital Analytics

What are some of the biggest challenges that you’ve faced in relation to brokering deals/sales?

Initially, right after COVID-19 struck, the biggest challenge we had was a lot of people in the acquisitions department at companies suddenly became asset managers. It was basically, ‘Pencils down, we’re not looking at new deals. We’re trying to understand what’s happening in the economy and to trying to assess what we have in our current portfolio.’ That was our first challenge.

Now, that wasn’t everyone – I would say about a third of the buyers who were active before the pandemic hit were ‘pencils down,’ with the second third looking for the perfect deal they could get at a discount, and the third bucket were buyers still actively underwriting deals and moving forward like before the pandemic. After asset management work started to slow down the next question was how are they buyers going underwriting future deals?

Pre-COVID, underwriting assumptions were difficult, but you could at least make reasonable assumptions for what rental rates, vacancy rates, leasing absorption and cap rates should be. However, those assumptions became much more challenging in an uncertain world where you don’t know which tenants are going to make it and which ones were aren’t. The challenge became how do we work with our buyers to meet this new kind of middle ground.

After that, the last challenge was logistical – as we market these properties to out-of-market buyers, how do we get them on-site? Certain states had travel restrictions, including Florida, so some buyers couldn’t get to Jacksonville even if they were willing to get on an airplane. Other groups were able to travel, so we had to develop new protocols for handling property tours to make sure they complied with the CDC and local health authorities. This meant sometimes touring after hours to limit interaction with tenants’ staff and also by mandating masks and social distancing. The same logistical challenges existed for buyer’s lenders, property inspectors and others third-party vendors.

What does the future hold for the Jacksonville market as a whole?

Long term, I think the future is bright for commercial real estate in Jacksonville. I think the positive trends here are very real, and they’ve been developing for quite some time now.

What we see now is an increased amount of national and even international buyer interest in Jacksonville that we really didn’t see as much of 10 years ago. By no means do I think Jacksonville has become a gateway type city like New York or San Francisco, but I think we’ve moved up to a secondary market with strong demographics. And since the pandemic a lot these secondary markets that are more suburban focused are getting more attention from buyers than gateway markets. These buyers can acquire property in Jacksonville for yields (investment return) higher than those of similar assets compared to most of our peer cities.

With Jacksonville, there’s been steady population growth and increasingly strong job growth over the past decade. Even during this pandemic our unemployment rate has been significantly lower than the overall state. And as of August, unemployment for Jacksonville is already back down below 6% which isn’t too far off levels seen pre-pandemic. Combine that with great weather, no state income tax and a diversified job base with a heavy focus on logistics, healthcare, military and technology service, I think we’re going to continue to see strong growth in the decades to come.