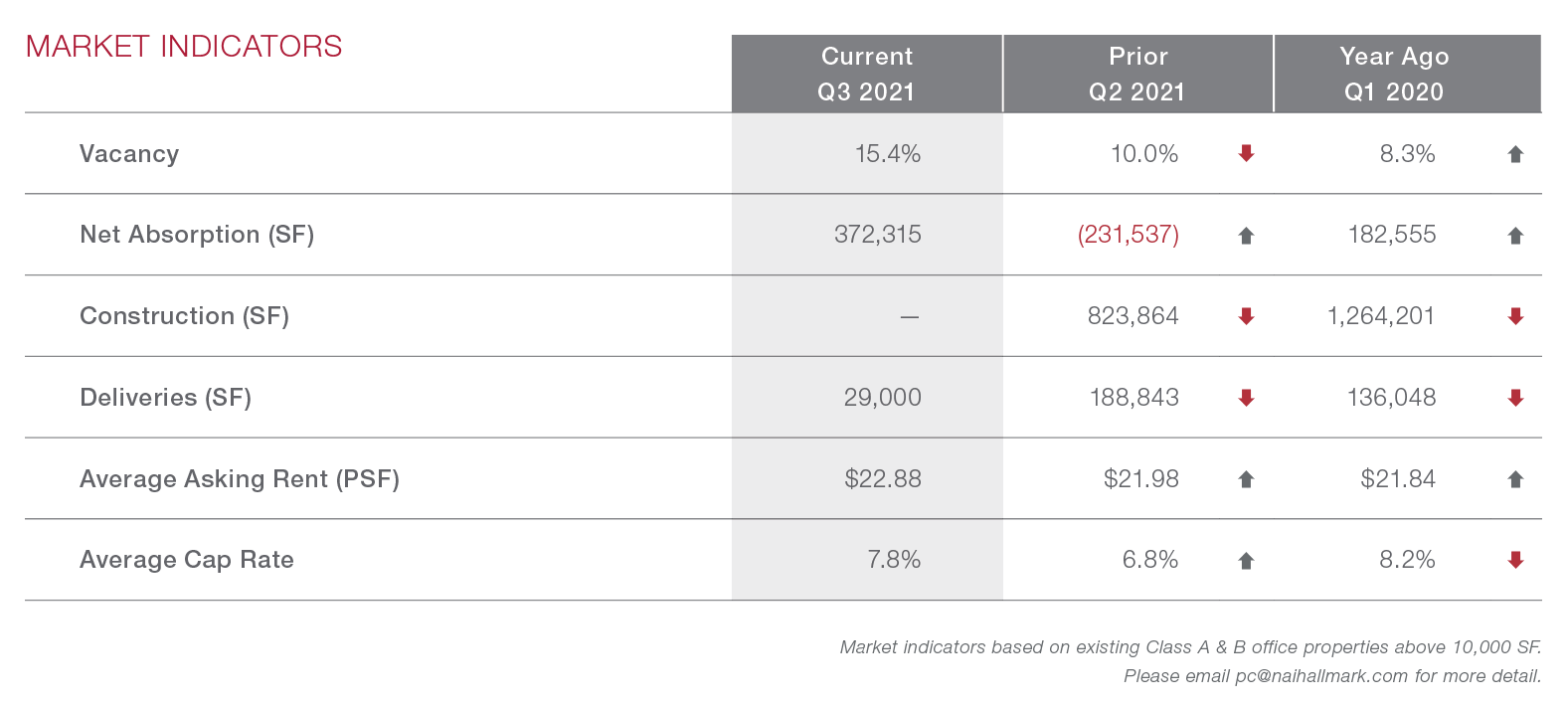

Office asking rent growth is still increasing annually, a marked contrast to most national markets. Sublet space is at an all-time high and the average vacancy rate is the highest it has been in seven years. On the other hand, leasing activity picked up in the first half of 2021. and will continue with the return of workers to offices.

Office investment activity significantly increased in the second quarter of 2021, the largest sales volume of the pandemic era. Owner-users have been responsible for nearly one-third of all transactions over the past 12 months.

Construction activity has had only a minimal effect on market fundamentals as most projects have been build-to-suit. Downtown Northbank is seeing the majority of the region’s current construction. In the second half of 2020, both FIS and JEA broke ground on new build-to-suit headquarters in the submarket. These two projects account for over 50% of the entire Jacksonville market’s office space underway and both expect to complete in 2022. In all, Downtown Northbank is contributing nearly 70% of the entire market’s current pipeline. No other submarket has more than 70k SF underway.

“The Jacksonville office market has continued to surprise as it outperforms many major markets across the country for yet another quarter. While still lagging behind pre-pandemic levels, Jacksonville office vacancies have compressed and rent has seen positive growth along with increased leasing activity during Q3. With concern of the Delta variant waning, we expect the market to build off of the recent momentum into Q4 and Q1 of 2022.“