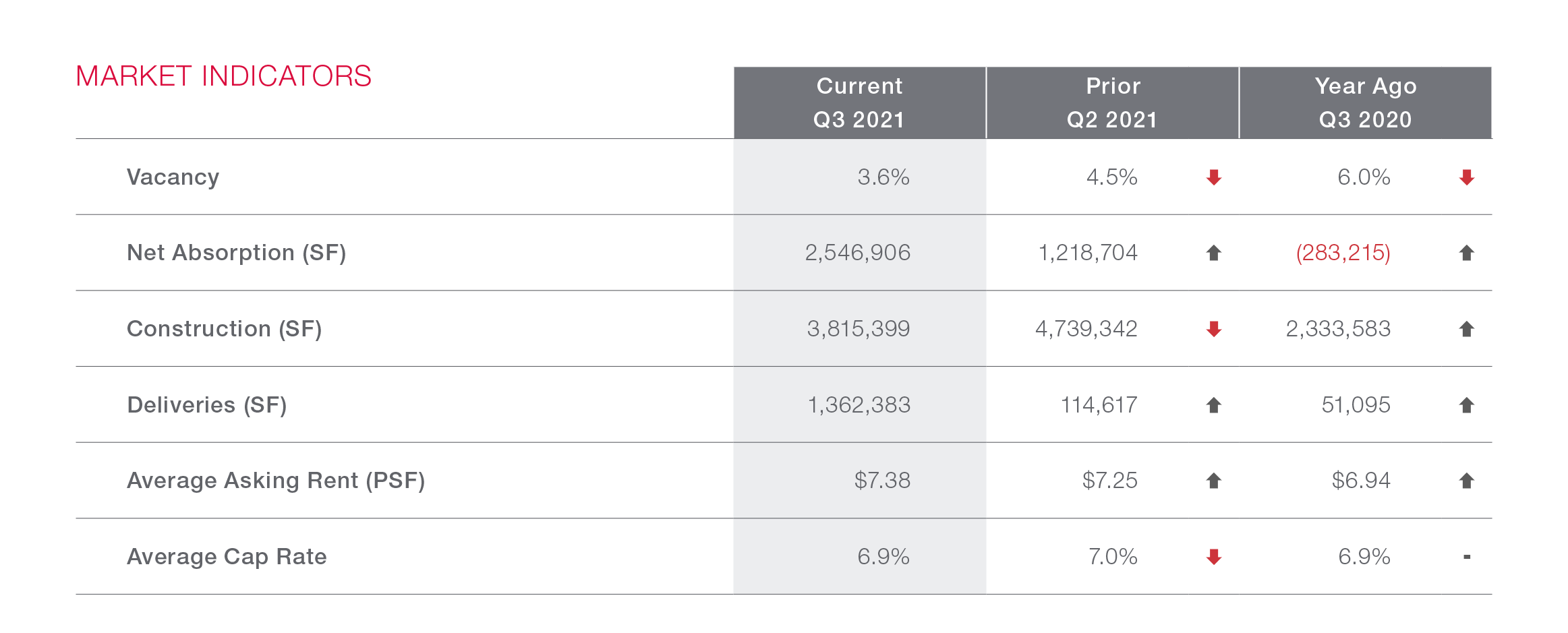

Jacksonville’s industrial market has tightened significantly over the past year, thanks to minimal supply additions and improved demand. Nearly 150 basis points have been slashed off the average vacancy rate during this time period as vacancies returned to early 2019 levels.

Leasing volume has slowed slightly over the past three quarters though still remains well above the five-year average and near historical levels. There is little reason to expect any significant weakening of market conditions over the near term. Total available space has declined by 3 million SF over the past year and while supply is elevated with 3.8 million SF underway, roughly three-fourth has already been preleased.

Sales volume bounced back in the third quarter of 2021 after downshifting over each of the prior three quarters, including falling below the five-year average in 21Q2. The third quarter rebound was led by the five-building portfolio trade (including four buildings in Westside Industrial Park) for $148 million, the sale of the still under construction Building B in Imeson Industrial Park for more than $50.8 million, and the two-building sale of Freebird Commerce Center for $35 million.

The tight market conditions are fostering strong rent growth. Annual growth rates have held relatively flat over the past year at 6.1% year-over-year, a rate well above the market’s historical average and in line with the national index. Logistics space has been a rent growth standout since late 2020 and appears poised for additional gains with steadily tightening vacancies over the past year.

Access to Jacksonville’s improving infrastructure and its relative affordability has drawn expansion-minded companies should continue to attract and fuel future large leases in logistics and especially regional distribution centers. Jacksonville also boasts a growing blue-collar workforce, a necessary component for third-party logistics and e-commerce firms seeking new markets and expansions. According to Industrial Vice President Jason J. Purdy, “Jacksonville’s geographic location in northeastern Florida is a net positive as well for businesses as a large portion of the east coast can be reached within one day. Combined with the large volume of vehicle and containers through JAXPORT, this is a great area for business.”

“An amalgamation of factors has continued to spur growth in Jacksonville’s industrial sector. The City’s business friendly environment and growing consumer base drive demand for distribution facilities in the Jacksonville MSA. We expect this demand to push rent growth into the future until new supply catches up.”

SUBSCRIBE TO OUR NEWSLETTER

Get the Latest Retail Brokerage News

Sign up to receive our email newsletter for updates on new retail listings, industry news, and market research delivered right to your inbox.