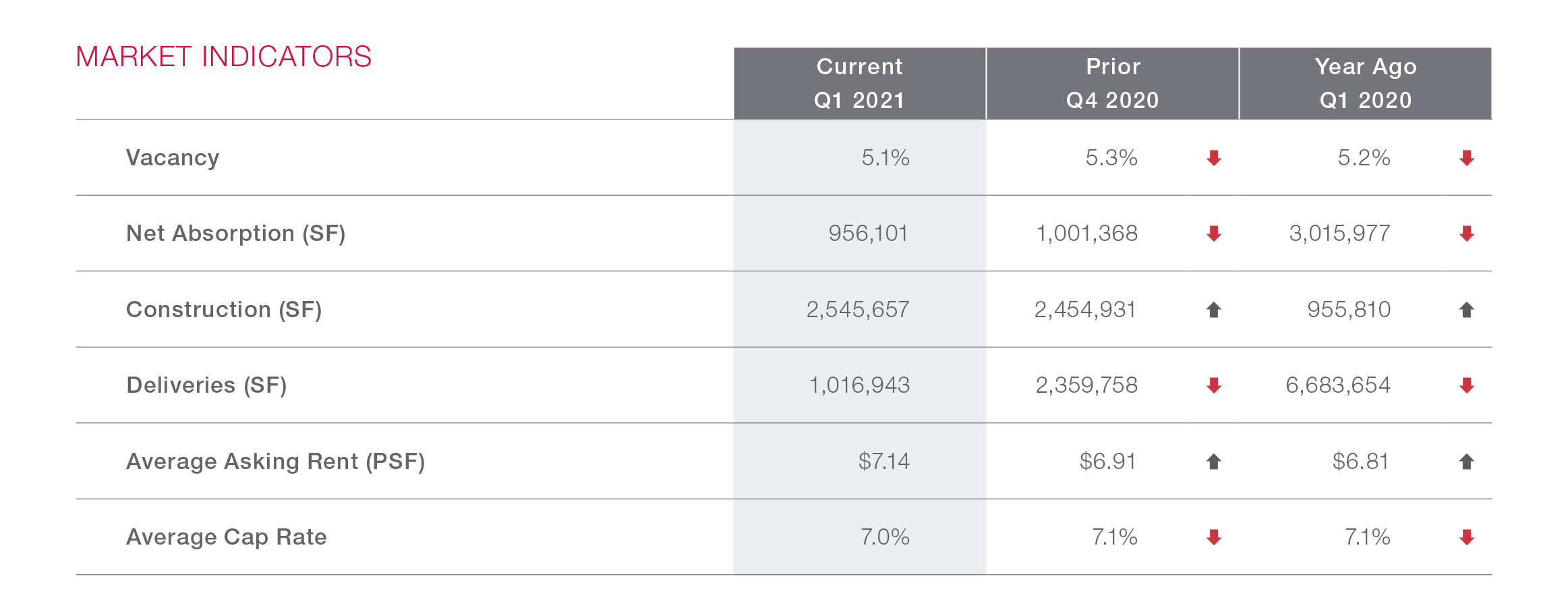

While Jacksonville initially saw industrial vacancies climb due to supply-side pressure, levels have been falling in recent quarters. Several large move-ins in the latter half of 2020 helped boost net absorption figures and bring down the vacancy rate for Q1’21 to 5.1%. Moreover, tenants remain active in leasing space in the market helping keep vacancy levels below the historical average. With the limited speculative pipeline, vacancies should also hold near or below the national average in the near term.

According to industrial associate Camden Padgett, “In the transition from the confusion and uncertainty of 2020 into 2021, we have seen a booming demand in the Jacksonville industrial market. Vacancies continue to decrease as we see demand grow. Demand for small-bay, dock-high industrial space throughout Jacksonville has grown beyond the supply of the market.” According to CoStar and internal data, there is less than 200,000 sf available for small-bay tenants in the entire market. Padgett continues “We hope to see an increase in dock-high development to accommodate new tenants coming to market. However, there is a struggle for land between industrial developers and the exploding residential market of Jacksonville.”

At $7.14/SF, the average industrial rent in Jacksonville is roughly 30% less than the national average. Although asking rents are significantly lower than the national average, they continue to increase in the Jacksonville market as supply is tight and demand is strong, according to Industrial Brokerage Vice President Jason Purdy. With smaller facilities that incorporate more flex space, the Beaches Submarket leads the metro in rents, at roughly $13/SF on average. Among larger industrial properties over 250,000 SF, rent growth has softened in recent quarters primarily due to landlords competing with recent new supply.

Around 2.5 million SF of industrial space is underway, with 65% of space under construction pre-leased. Compared to the only 45% and 30% pre-leased rates in Atlanta and Orlando respectively, supply-side pressure in Jacksonville will be less of a concern in the coming quarters.

Jacksonville’s market pricing offers a relative value compared to peer markets. At $67/SF, market pricing is well below nearby Orlando, Tampa, and Savannah. Additionally, cap rates are in the lower-7% range after compressing in recent years.

“2021 and beyond will be a bright future for Jacksonville. Due to changes in the political climate, we have seen a strong migration to the business-friendly state of Florida. As development in Jacksonville grows, this has potential to bring many jobs to the city. New tenants and owner-users are enjoying the amenities of Jacksonville including major interstates and JAXPORT.”

SUBSCRIBE TO OUR NEWSLETTER

Get the Latest Retail Brokerage News

Sign up to receive our email newsletter for updates on new retail listings, industry news, and market research delivered right to your inbox.