Although sales volume has decreased slightly from Q4’20 (the strongest quarter for sales volume in the market’s history), it is still well above the market’s long-term annual average. Market pricing continues to increase, currently averaging $148K per unit, while cap rates continue to compress.

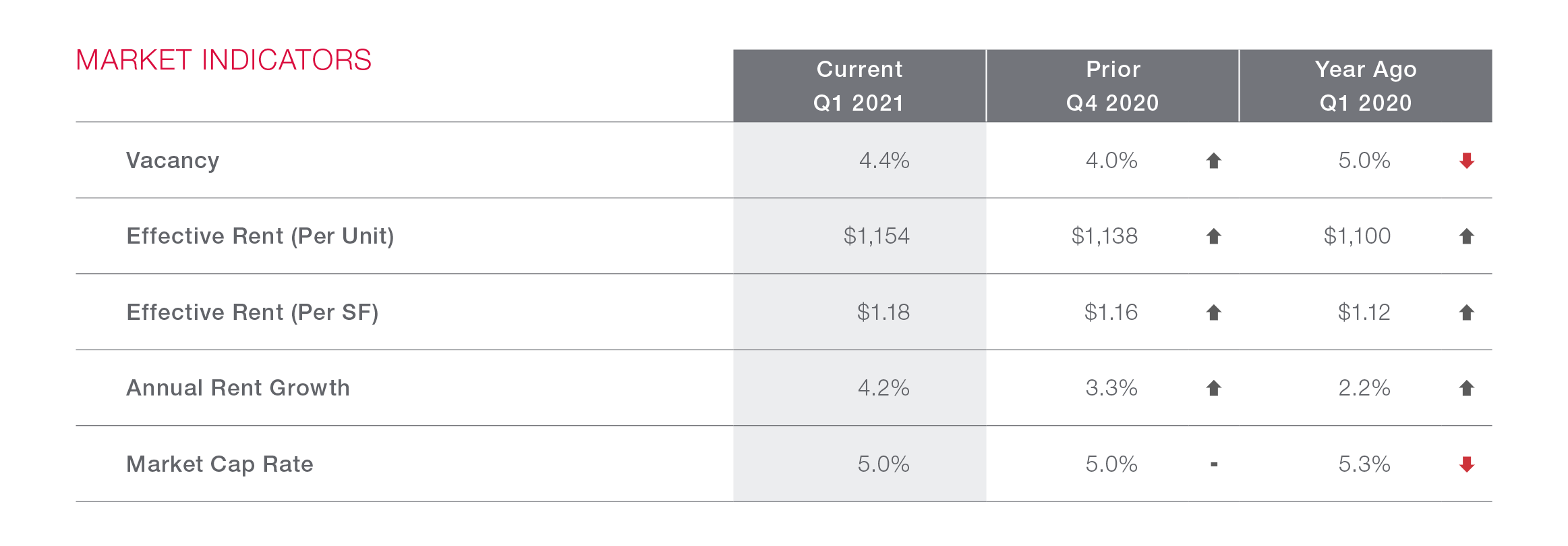

Effective rents, now averaging $1,154 for the Jacksonville MSA, increased 4.2% year-over-year during Q1’21. The MSA saw the 5th largest rent increase among the major South region markets and the 10th largest increase among major markets nationally. Although vacancy levels have increased slightly, they are still trending below the overall annual average for the past five years and placing Jacksonville in the top 25 of 50 largest markets based on vacancy.

SUBSCRIBE TO OUR NEWSLETTER

Get the Latest Multifamily Investment Sales News

Sign up to receive our email newsletter for updates on new multifamily listings, industry news, and market research delivered right to your inbox.