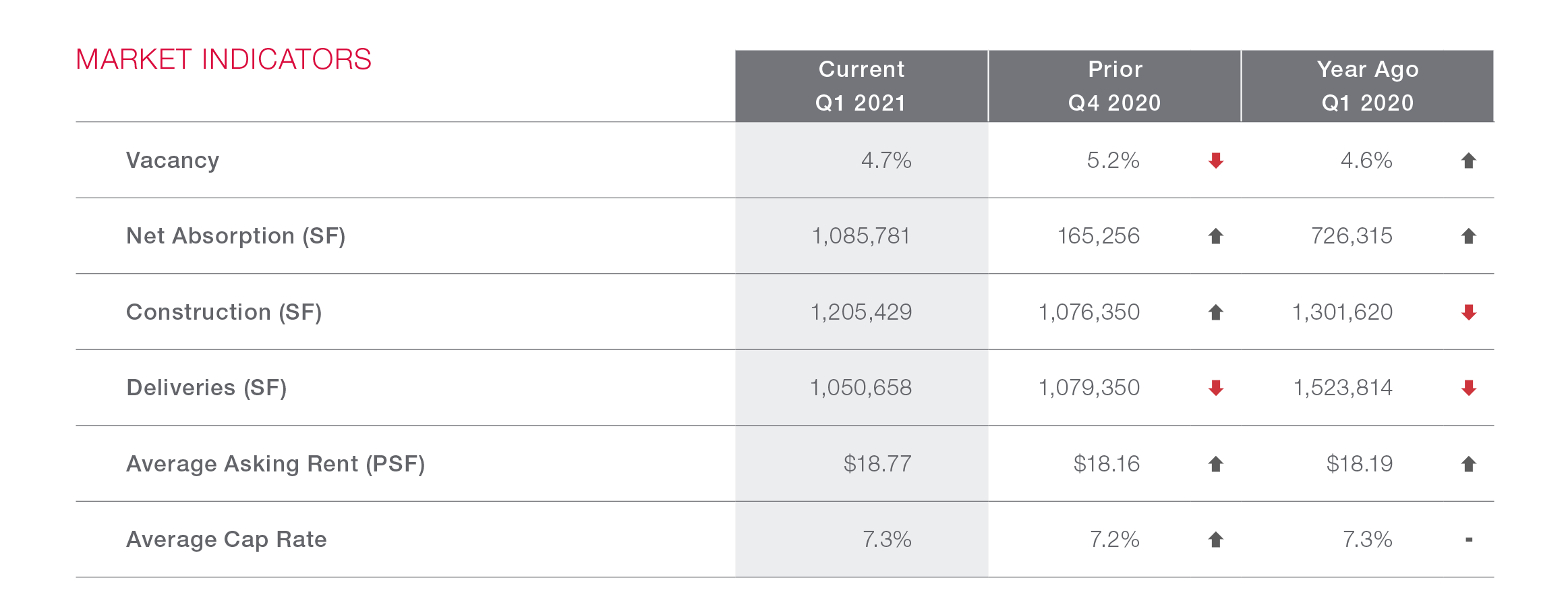

Retail vacancy has been ticking higher over the recent quarters in Jacksonville. Leasing activity is still below pre-coronavirus pandemic levels, and some speculative deliveries will likely cause vacancies to continue rising in the coming quarters. Despite this, the vacancy rate remains comfortably below the historical average and in line with the National Index.

Jacksonville is one of the fastest-growing metros in the country on a percentage basis. A strong population growth boosted consumer spending, which in turn bolstered retail demand. Developers followed suit and are currently 1.2 million SF of retail construction is underway. This represents around 1.2% of inventory under construction, well above the national figure. Roughly 70% of the retail space underway is preleased, and supply-side pressure on the market is not a major cause for concern in the near term.

Restaurants and chains continue driving leasing volume in the market. Over the recent years, major specialty and discount grocers leased and moved into new space in the metro, which helped bolster net absorption rates. Whole Foods is also underway on a 34,400-SF store at Jacksonville Beach, while in San Marco, developers are working on a new ALDI store that will encompass 20,400 SF. Both stores are expected to open early next year. Additionally, Earth Fare leased 24,000-SF of space at a St. Augustine shopping center and is expected to move in Q2’21.

At over $18.70/SF, the average retail asking rent in Jacksonville is 20% lower than the national average. Among submarkets, Butler/Baymeadows commands some of the highest asking rents at over $26/SF. The heavily tourist-focused Beaches Submarket has the second-highest average rent, near $24/SF. Other high-rent submarkets include St Johns County and Downtown Southbank submarkets, both offering average asking rents around $21/SF.

“Jacksonville’s retail market appears to be on the rebound after Q1 2021. The formula of continued population growth, increased vaccination numbers, and a significantly lower average asking rent compared to the national average make for an attractive landing spot for retailers and restaurants alike.”

SUBSCRIBE TO OUR NEWSLETTER

Get the Latest Retail Brokerage News

Sign up to receive our email newsletter for updates on new retail listings, industry news, and market research delivered right to your inbox.